How much do the 1% pay in taxes?

No taxation without blog post explanation!

Disclaimer: In this post, I define the 1% as the top 1% of income earners, which means annual personal income above $500,000. This can be a bit misleading and I will be doing a followup post on the 1%. I will link to that post here when it is available.

In an age where conspiracy theories spread like chickenpox at a Jenny McCarthy pool party, the tax protestation movement has, amazingly, yet to go mainstream. There are thousands of tax protesters in America, people who genuinely believe taxes are unconstitutional for dozens of different reasons, all of which hold up as well as chemtrails on a cloudy day. Among their numbers is Wesley Snipes, who served a prison sentence because he believed US citizens were exempt from paying US taxes. How is it that mass fluoridation, Area 52 probings, and Illuminati mind control have millions of enthusiasts but nobody pays attention to tax protestation? I suspect foul play. This is the greatest conspiracy of all. Think about it: taxes are the ultimate communist plot. People hate taxes. They hate them more than the mafia hated JFK, more than big pharma hates homeopathic cures. My working theory is that the tax protestation conspiracy is being suppressed by a powerful consortium led by noted Freemason Tupac Shakur. Unfortunately, until that is proven, taxes are really important. The goal of this post is to understand who and where taxes come from.

How Big of a Deal are Taxes?

Let’s look at the three government entities that collect taxes: federal, state, and local governments. Across the board, taxes account for over 80% of government revenue. Safe to say that without taxes, we wouldn’t have potable water, post offices, or Judge Judy’s court. Worse, our senators would be bereft of their $174,000 salaries, meaning they would have to scrape by on paltry bribes from lobbyists and foreign agents.

What are the types of taxes that people pay?

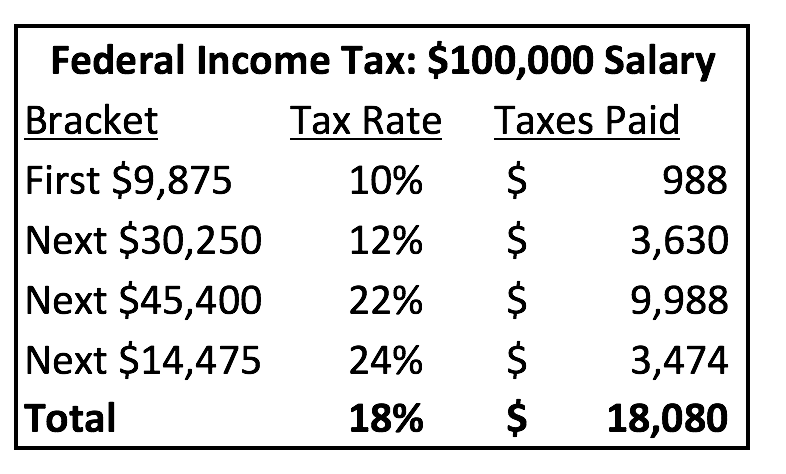

Income Tax: This tax is levied by federal, state, and local governments and is typically a progressive tax, which means that higher income is taxed at a higher rate. The rate is determined by a “tax bracket.” A common misconception, usually by your idiot high school friend that you need to stop hanging out with, is that earning more money could leave you with less after-tax income. The way the bracket actually works is by raising taxes only on marginal dollars earned:

On state and local levels, income taxes vary. Texas and Florida have no state income taxes, while the highest bracket on New Jersey income is over 11%, a hefty price to pay to live in America’s sewer.

Payroll Tax: Federal taxes that fund Social Security and Medicare. They are pretty similar to income tax except this is a flat tax of 12.4% that applies only on income up to $137,700.

Sales Tax: A type of consumption tax (pay when you purchase) that is an important revenue source for state and local governments.

Property Tax: A wealth tax based on property value mainly used to fund local governments, particularly school districts.

Corporate Income Tax: Corporate income tax, which is tabulated as a percentage of a company’s profit, is a pretty small piece of the overall pie. That’s surprising considering how much attention it gets in the public policy sphere. Corporate income is subject to a phenomenon called “double-taxation.” Companies pay tax on their corporate profits. Then, those same profits are taxed again when they are distributed to owners of the company, who classify it as personal income. Every time income is double-taxed, the estate of Ayn Rand purchases and burns down a soup kitchen, per her will.

Other Taxes: There are endless variations of taxes on the books: excise taxes (on goods like soda or cigarette taxes), inheritance taxes, city taxes.

Who Pays Into the Pot?

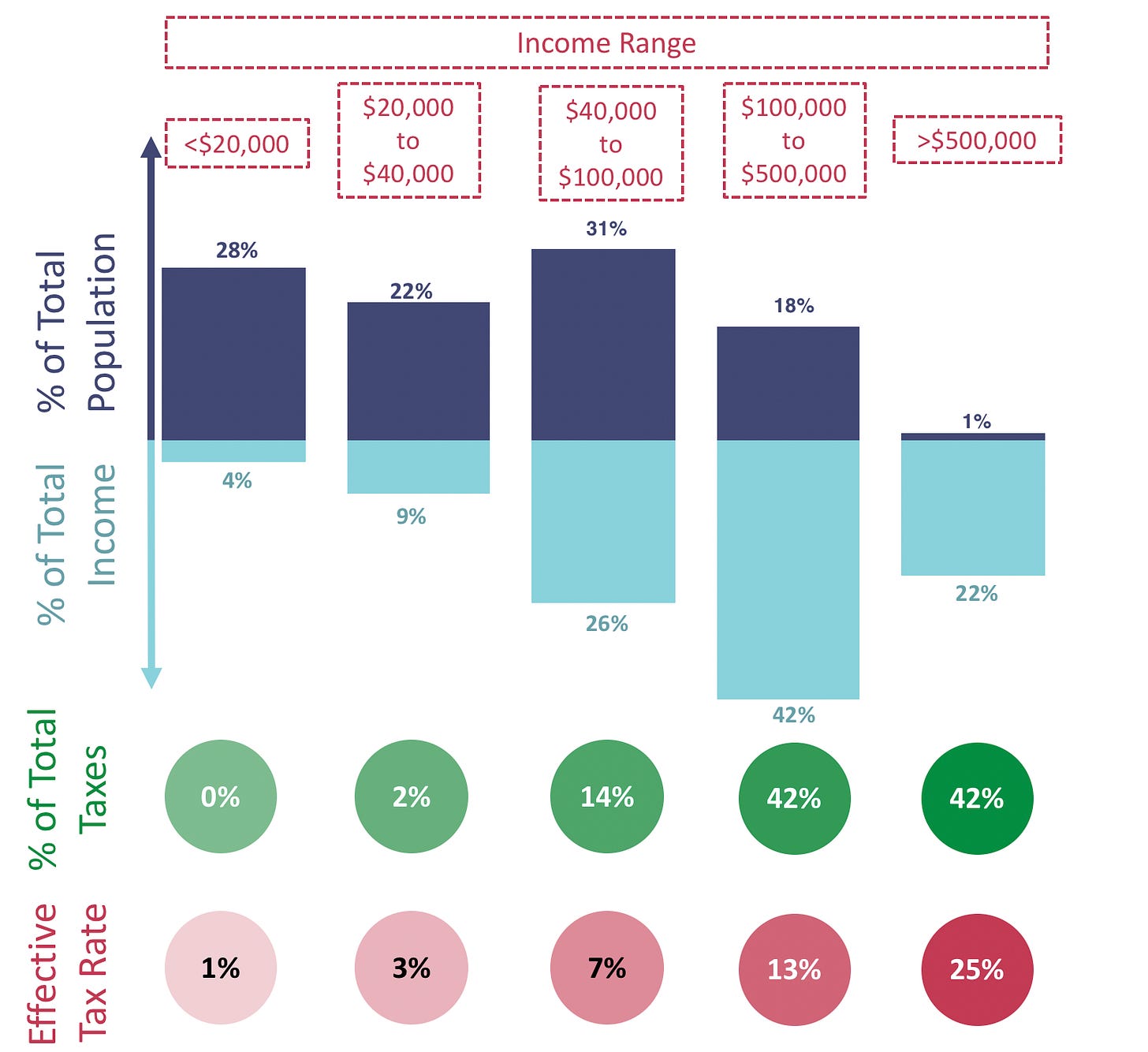

To answer this question, let’s focus on federal income tax; it’s the largest bucket and has the best available data. I broke taxpayers into five buckets, with the final bucket on the right being top 1% earners.

To answer the question in the title, the 1% pay 42% of all federal income tax. There’s a lot of nuance to the data and a lot of opportunity for misrepresentation. For example, one common statistic cited is that something like 50% of Americans don’t pay income tax. After adjusting for government benefits this may be about right, but it doesn’t account for other taxes like sales or payroll tax. Another statistic is that the 1% don’t pay taxes. That’s true in some cases, but not in totality.

Is it Fair?

That’s for you to decide. The fact is, the government is largely funded by a progressive income tax. Some people think that’s fair, some don’t. The argument that the rich don’t pay enough, usually made by mushy-brained socialists as they sip craft coffee and cede domestic territory to their cats, is that the progressive scale doesn’t work right. Effective rates, taxes paid divided by income, are far below statutory rates, aka the rates on the books, because of an over engineered tax code with more holes than Bin Laden’s shadow. Plus, the other taxes (sales, payroll) are a relatively higher burden on smaller incomes. The counterargument, made by capitalist pigs who don’t bag their own groceries, is that the rich pay by far the most taxes, measured in absolute dollars per capita. Feel free to deep dive the data sources below all you want, but at the end of the day it’s going to be an opinion.

An alternative way to assess our taxation framework is the compare it to other countries. Often times the tax conversation is about who pays; but the bigger question is how much is needed. The US collects far less in taxes vs. peers, which may be somewhat surprising given the military budget (less surprising when you factor in health care).

Relating to the “who pays” discussion, the US relies more heavily on income tax and less on consumption tax vs. peer countries.

Additional Reading & Data