what would Harvard be worth if it IPO'd?

Or what if a leveraged P/E firm bought it out and raised the prices?

Harvard is one of the world’s greatest businesses. A brand stronger than Disney, a galactic endowment, an alumni base whose cumulative tax avoidance surpasses most country’s GDP. It begs the question: what is this company actually worth?

The conventional approach to valuing a business is to collect publicly reported financials and other available information then apply different investment techniques such as a discounted cash flow model. That’s the general approach of this post but it requires some imagination to get there. To value Harvard like a stock will mean pretending Harvard is trying to maximize value for shareholders. Right now it’s not doing that. Harvard’s a non-profit.

This is more a thought experiment on what would happen if Harvard converted its structure to for-profit to enrich supposedly philanthropic founders and investors. Which, of course, is unrealistic because who would do that?

Harvard University consists of twelve schools enrolling a total of 25,000 students. That’s not all though. There’s also the $53 billion endowment. There’s also the library system, a dozen museums, online education platform HarvardX, and 5,000 acres of real estate. And, in an undisclosed location, there’s a cryochamber containing a couch cushion with a perfectly preserved imprint of Henry Kissinger’s ass, priceless in its own right. Given this sprawl of assets a sum-of-the-parts valuation approach makes sense. Sum-of-the-parts = each division is valued separately and the total valuation is calculated as…a sum of the parts.

Harvard Colleges

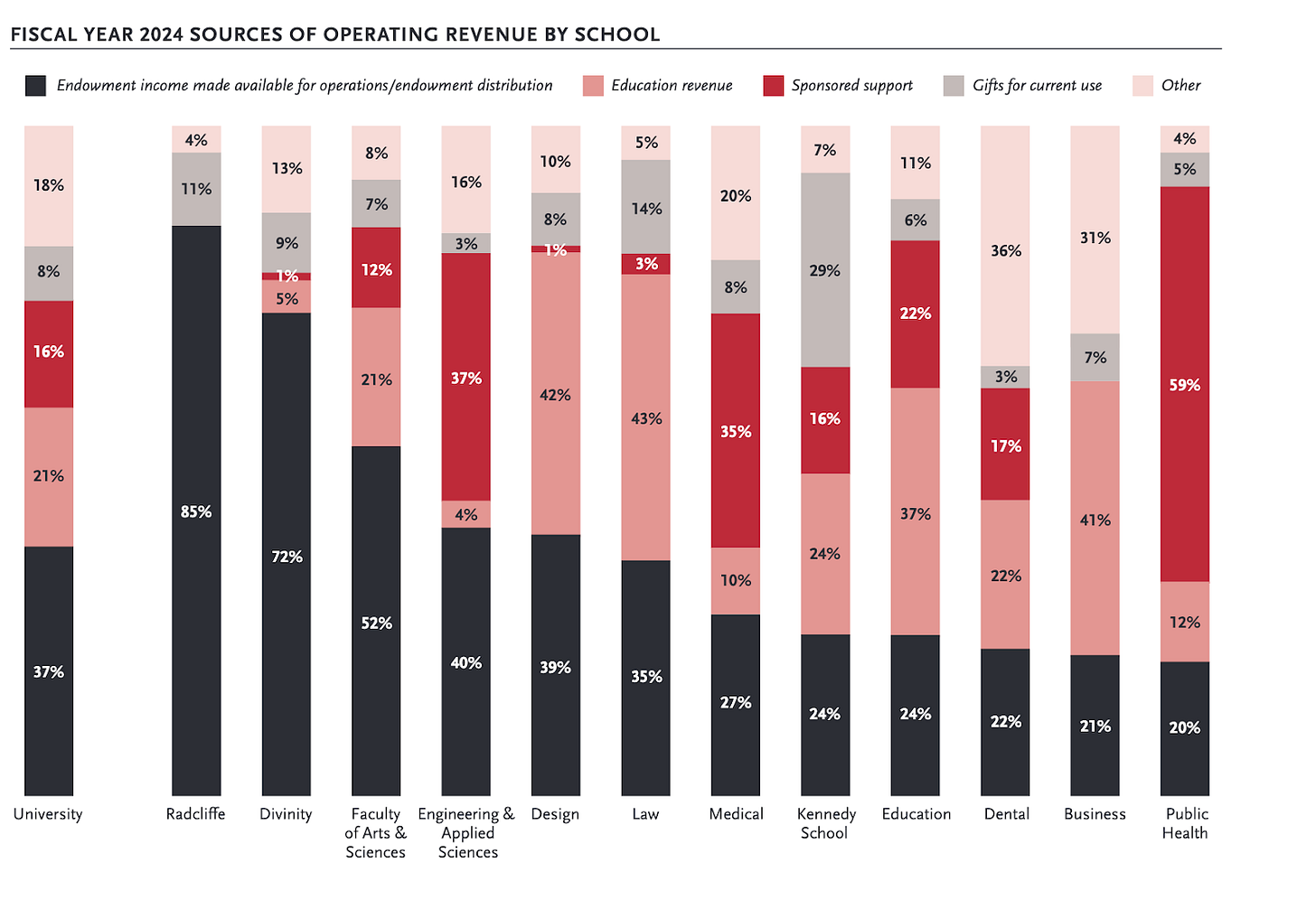

The first challenge is that the university itself is funded by grants, gifts, and from the endowment. For this exercise we’ll assume that all of those go away as part of the for-profit conversion. Or maybe it all gets taken away by the President. Either way, we’ll assume Harvard operates like a normal for-profit school where operating revenue comes primarily from tuition & fees.

The second challenge is that Harvard doesn’t set its tuition at a market clearing price. For example, Poets & Quants estimates that Harvard MBAs go on to have average career earnings of $8.5mil. That’s about $4mil more to comparable skilled workers without Harvard MBAs. Some rough math ($4mil discounted back to the present at a 5% rate) suggests the fair value for a Harvard MBA is something like $2mil whereas tuition is <$200k. In other words, if Harvard behaved like an American health insurer then it would be charging 10x the tuition.

One way to get around all of this is to value Harvard per seat. Harvard has 25,000 seats across all its programs today. There are publicly traded for-profit universities in the US like Grand Canyon Education (LOPE) which runs University of Phoenix. On average these companies have current market valuations (enterprise value) of ~$40,000 per enrolled student. Applying that valuation to Harvard would yield ~$1bil valuation. That’s not really fair though because comparing a Harvard degree to a University of Phoenix degree is like comparing a Ferrari to a Fiat. Harvard degrees are worth way more and therefore the company should be valued more. Actually, the Ferrari to Fiat analogy can be useful because Ferrari is publicly traded. Ferrari trades at 42x earnings, whereas the typical European auto company trades close to 5x earnings. Ferrari’s valuation premium is 8x. If Harvard is the Ferrari of schools, then it should trade not at $40,000 per seat (like University of Phoenix) but at 8x that - $320,000 per seat. That yields a total valuation for Harvard of $8bil.

$8bil doesn’t seem like enough for one of the most influential cultural organizations in the world. Yet financially it makes sense. After stripping out the endowment revenue (valued separately), philanthropy revenue (already excluded) Harvard makes about $3bil in revenue. Looking at publicly traded universities around the world, most do about a 10% net profit margin. Run as a business, the colleges of Harvard would probably earn $300mil a year in profit. That’s less profit that Albertson’s grocery store chain made (market cap $12bil). It’s about what Nordstrom made last year (market cap $4bil).

But maybe Harvard colleges would be more valuable to a strategic buyer. As in, a buyer who doesn’t care about making profit but cares more about extracting some other type of value. Like when Elon Musk bought Twitter or Jeff Bezos bought the Washington Post. Whoever buys Harvard colleges might be interested in exploiting the soft power of the school, the alumni network, and the research institutions. Elon Musk paid ~10x revenue for Twitter. If we apply that revenue to Harvard’s $3bil (with the earlier exclusions) then we reach a valuation of $30bil. That seems like a much more realistic price tag. Another trophy asset, the Boston Celtics, recently sold for 13x revenue, so it could be argued that $30bil is the floor.

Final value: $30bil

Library System

Say the library and its assets were sold off to the highest bidder. And say the highest bidder was a profit-seeking vulture, a real heartless capitalist, the type that french their own grandma if it got them an invite to Davos. Well the first thing the buyer would do is fire everybody. Who needs a librarian? The second thing they’d do is close down operations. Libraries don’t make money. This vulture cares about one thing: the rare book collection. The Harvard Library book collection is estimated to be one of the most valuable on the planet, alongside the British National Library and Yale’s Beinecke Library. It includes a Gutenberg Bible (estimated worth $25 million), first edition Shakespeares, original prints of Galileo’s books, and presumably hundreds of JFK’s schoolboy sketchbooks filled with busty stick figures. If the vulture sold the library off piece by piece, what would it fetch? It’s really impossible to say because there isn’t even a publicly available inventory of the collection. What is known is that Harvard Library has 250,000 rare books. Not all will be worth $25 million like the Gutenberg, but if the average rare book fetches $10,000 then the total collection of the library is at minimum $2.5 billion. This puts no value on the library’s digital assets, millions of non-rare books, or the other rare manuscripts and documents it may have. At the very least, an average value of $100 per item, adds another $1 billion to the value. This might be conservative. French Historian Patrice de Moncan went through the Louvre’s collection and valued it at $35bil.

Final Value: $3.5 billion

Museums

Harvard owns and operates over a dozen museums. This is the same exercise as the library - the value is in the collection. There are public estimates of collections for other large museums (like the Louvre) but it’s still guesswork. Sparing the reader another long paragraph, the estimated figure is $10 billion for the Harvard museums & their collection.

Final Value: $10 billion.

HarvardX

This is Harvard’s online education platform. It’s mostly free online classes based on Harvard’s curriculum. Coursera, a competitor, is publicly traded and has a market cap of about $1 billion. This is a small part of the total portfolio so it doesn't make sense to spend too much time here.

Final Value: $1 billion

Real Estate

Harvard owns 5,000 acres of real estate. 4,500 of those acres are ecological forests & arboretums. To simplify, assume those lands are worth $0. They are mostly not in prime real estate areas and might be legally difficult to commercialize anyways. The valuable real estate is 500 acres in downtown Cambridge. Land in Cambridge goes for $15mil/acre. That means Harvard’s real estate is worth a minimum of $7.5bil.

FInal Value: $7.5bil.

Endowment

Harvard has a $53bil endowment. This includes financial assets (but not the aforementioned real estate & artwork). It stands to reason that the endowment should therefore be valued at $53bil. The catch is that at least 80% of the endowment is donor-restricted, meaning that the university is contractually obligated to spend the money on a specific use. For example an alumni might donate $1mil to fund a scholarship program. Therefore the actual monetizable value of the endowment could be a fraction of the reported value today. One simplifying assumption is that Harvard has graduated many of the world’s pre-eminent money launderers, tax evaders, and contract disputers. If anyone can find the loophole in these restricted donations, it’s Harvard. The verdict here is that the endowment is to be treated like cash on the balance sheet.

Final value: $53 billion

Brand

Maybe the most compelling asset Harvard has is its brand. Disney’s brand is valued at $50bil, shouldn’t Harvard be more? Not for this exercise. The value of the brand is indirectly incorporated in other valuations, like the colleges.

An investment banker really trying to inflate the value of Harvard might argue for untapped brand potential that isn’t captured in other areas. Could Harvard double the number of students? License the brand to foreign entities to open Harvard campuses in Thailand? Bring in the management team from Disney to really milk this thing to the bone? Dig up alumni John Quincy Adams and sell his bones on Ebay? Anything is possible. Call it prudence, but none of that can reasonably be added into today’s valuation. Leave that as future upside for any buyer of the business.

Final value: $0

& Other Assets

There are some other odds & ends, like the inventory (books, food, paper), the cafeterias, but nothing that would move the needle. The Harvard Hospital system is a massive, multi-billion dollar operation but it’s actually an independent organization, not under the Harvard University umbrella.

Final value: $0

Final Valuation

Colleges: $30bil

Library: $3.5bil

Museums: $10bil

Harvardx: $1bil

Real Estate: $7.5bil

Endowment: $53bil

Brand: $0

Other: $0

Total: $105bil

In conclusion, Harvard University is worth ~$105bil. If Harvard IPO’d at this valuation, it would be one of the 100 most valuable companies in the United States. Slightly more valuable than Starbucks, slightly less valuable than Cigna health insurance.

Harvard is a national treasure whose heritage is irrevocably intertwined with American history. An absolute intellectual asset and symbol of innovation, cultivator of great leaders and thinkers. Who thinks it should be stripped down and sold for parts like a stolen Honda?