Why 401ks exist, what you should do about it

Making the right choices to save for retirement

If you like this newsletter please subscribe & share! Special shout-out to reader Brian M. from Denver who suggested I “cut off my own ear like Van Gough for brand awareness.” Thanks Brian, always an option.

Saving for retirement is difficult. In fact, it's more than difficult, it’s unnatural. We have evolved biologically to survive, and we survive by consuming. We see food, we eat it. We see a cave, we sleep in it. Sure, we can squirrel away a few nuts for winter or save leftovers for tomorrow, but saving for forty years down the road? Evolutionarily irrational. The entire idea of retirement planning pits instinct against self-interest. Maybe that is why, for all of the wonders of modern civilization, retirement planning remains a struggle for almost everyone (or at least, ⅔ of the American population).

What is the 401k and why does it exist?

Humans have forever been trying (and failing spectacularly) to figure out life-after-work. In Shakespeare’s King Lear, the eponymous King bequeaths his fortune to two of his daughters so that they will tend to him in his old age. That proves to be a nice gesture, but a poor investment (the daughters leave him to rot). A few hundred years after Shakespeare, tontines, in which a group of people pool their savings and those who die last collect the whole pot, were a popular retirement solution in France. They are an elegant solution, although they do create an incentive for murder. The over-65 population in China gets over half of their income from their offspring, a situation that the one-child policy has made a ticking time bomb. The most efficient solution of course, pioneered by our ancestors in the plains of Africa, was to just die before you could retire - have your skull bonked in by a baboon or something. For post WWII America, the failed solution was pensions. Pensions are employer-sponsored defined-benefit plans. That means that one of the benefits of working the job is the paychecks keep coming, in predetermined amounts, even after the employee retires.

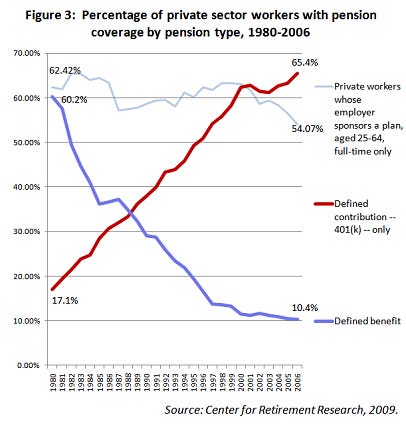

Pensions are rare these days, but those who have them tend to love them. Pensioners don’t have to worry about investing or saving money, they just cash them checks baby! The problem is that pensions don’t solve the retirement problem, they just transfer ownership of the problem. Instead of citizens making awful investment decisions, employers (i.e., governments and corporations i.e., groups of people) made awful investment decisions. Underfunded pensions, a term for organizations that promised pensions but didn’t save enough to make good on the promise, were an enormous economic issue in the 20th century and remain a serious threat to many state and local governments today. Look no further than social security, our nation’s unsustainable nationalized pension fund. By the way, Social Security doesn’t provide enough for most people to retire on, hence the need to come up with additional retirement income sources. In the 1980s, employers switched from defined-benefit plans to defined-contribution plans. Defined-contribution plans mean that employers and employees contribute a fixed amount, in cash, to a retirement account. Employees are responsible for managing how that money is invested. If there’s not enough money come retirement, the employee has no one to blame but themself. In this way, employers solved their problem of ballooning pensions (and employees re-inherited it). During this time, the government made defined-contribution plans like a 401k (or any of these accounts) tax-advantaged. The tax advantage of 401ks is that they are tax-deferred.

Ok, how do I take advantage of my 401k?

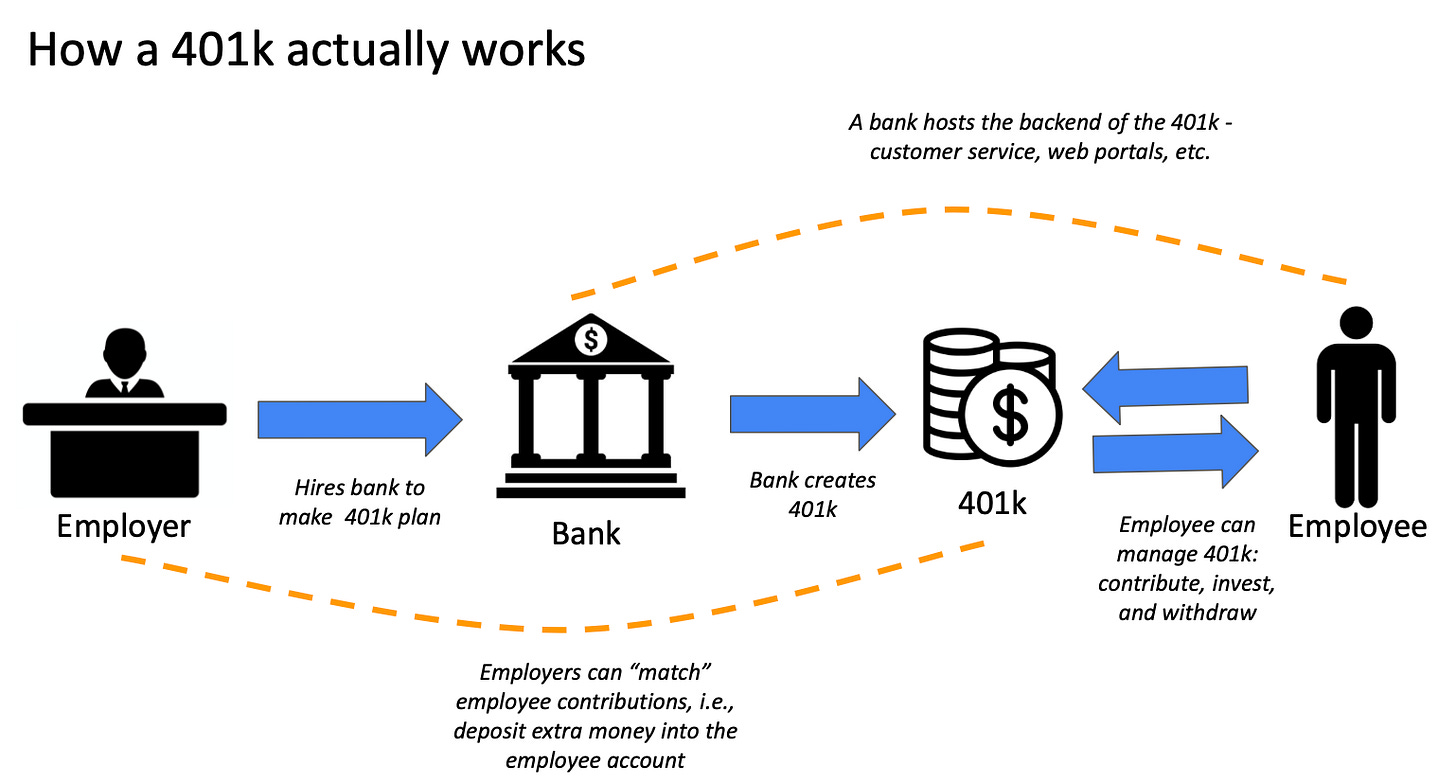

First off, see if you have one. 401ks (and equivalents) are employer-sponsored, meaning you only get one if your employer sets it up. If you don’t have access then IRAs are still an option but that’s a topic for a separate post. Second, figure out if your employer matches. Matching means that employers will contribute something to this plan on your behalf, usually contingent on you putting in money.

Setting up your 401k can be tricky because your employer sponsors the plan, but a third-party bank actually runs it. The easiest way to set up the 401k is to call your HR department.

Once set up, it’s pretty straightforward. You’ll manage the 401k through a website, the same way you manage any investment or bank account. You can choose where to invest your money and how much to contribute. The 401k account and the money inside it is yours. If you get fired or quit your job, the account stays with you. You’ll have the choice to keep the 401k or transfer the money (called a rollover) to a different retirement account. The one exception is that sometimes the employer’s contributions “vest,” which means employer contributions only officially become yours after a period of time (usually a few years). Basically, you have to stay at the company to earn that extra amount. By the way, don’t get me started on vesting. 401k vesting is extremely common and frankly should be outlawed. It’s a way for bad employers to create minor exit barriers for their workers (“Hey, if you leave now you’ll miss out on that extra $300 in your 401k!”). It’s pitiful. I almost feel bad for companies that are so crappy they need to pull a stunt like that to keep employees from running for the exits. It’s like the rich kid who uses his parents money to buy friends (“Tell Dave he can come to this party if he buys us all Netflix accounts.”) It’s cringeworthy. Good companies don’t need to trap employees. Yet, almost every company engages in this vesting bullshit. Here’s a better solution - just pay people to do a job and have a workplace that doesn’t repel them. Don’t resort to manipulative tactics that probably don’t work (show me evidence that this tactic improves employee retention, seriously). Personally, when someone tells me they work at a company that vests 401k contributions immediately, my first response is “that must be a great place to work.” Anyways, all the money you put in is yours no matter what, and the “vested” part of employer contributions is also yours forever.

Mandatory paragraph on compound investing

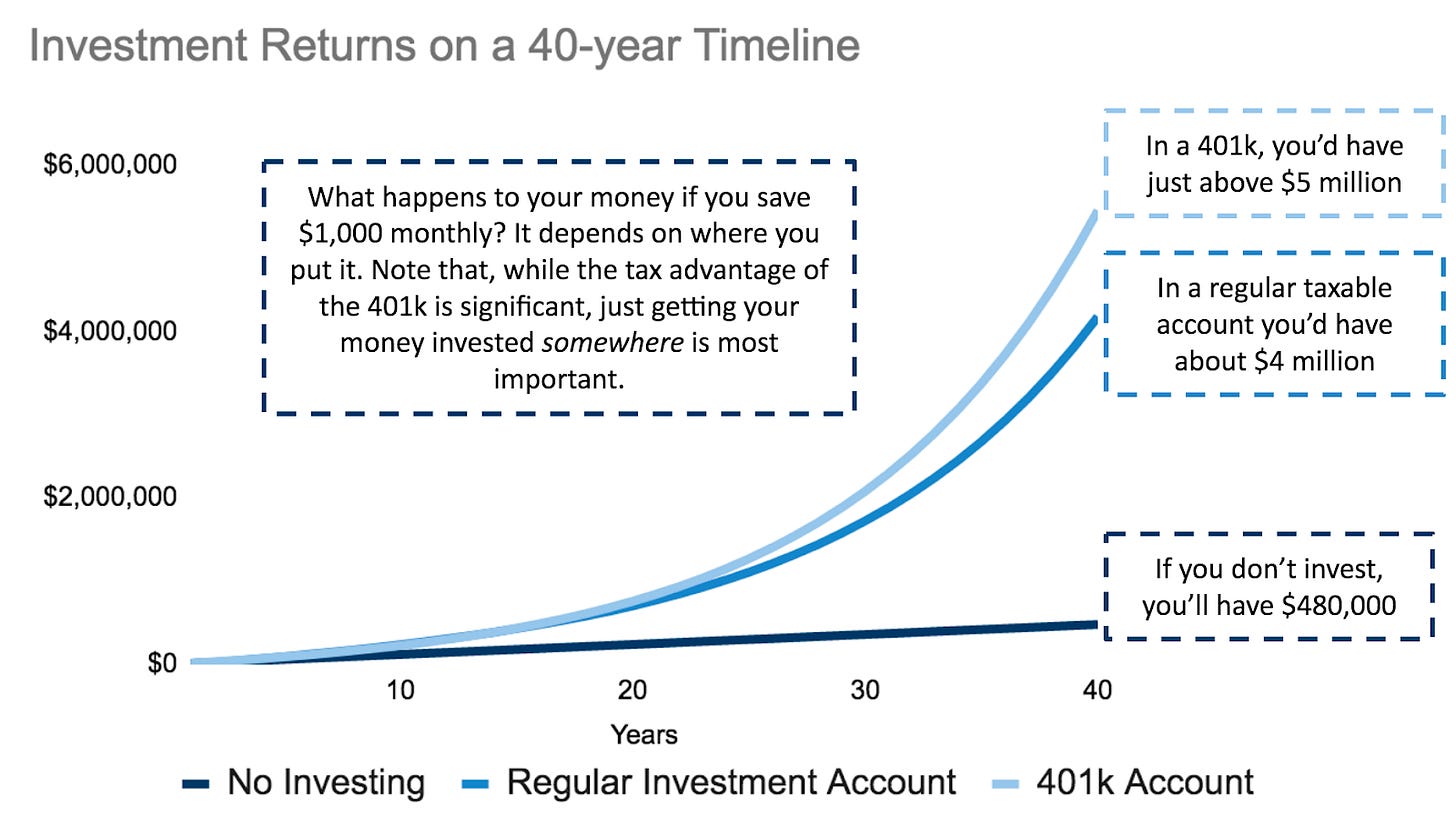

Here is the perfunctory segment of every retirement article where the author espouses the virtue of compound growth and tax-advantaged accounts. I know this point is beaten to death by the financial services industry, but if I don’t make it then I risk assassination by personal finance extremists. You know the type, the tik-tokkers who live in those tiny houses and eat dinner out of a can and make you feel like Marie Antoinette if you don’t reuse your floss. I’ll just say a 401k can be a powerful tool for your financial well-being, and I made this graphic about it:

How much to contribute?

Ok, so you have a 401k and you’ve got it all set up. Now you need to know what to do with it, as in, how much money should you put in? The two factors you need to account for are your budget and your financial goals. The budget is simple: you can’t contribute more than is available after expenses. Financial goals are a little trickier. The key is you want to get as much money as possible into tax-advantage accounts, but not so much that you don’t have enough to cover expenses over the next 40 or so years. You’ll need to think through the major cash outflows you expect in your life: mortgage down-payments, college tuition, mid-life crises, unplanned pregnancies, impulse purchases of high-end cutlery, ponzi schemes, vulnerabilities to unbelievably convincing time-share pitches, natural disasters not covered by insurance, ransoms paid to dognappers, and racketeering (whatever that is). This is the unsolvable problem of retirement. How can someone possibly plan out an entire lifetime? The good news is that you don’t need to. Your investments will compound AND they are tax-deferred.

A quick aside. When I used to live in Baltimore I volunteered at an after-school program for at-risk youth. If anyone asks, I love to give back. But between us, the real reason I was there was because every other Friday was dodgeball Friday. Dodgeball Friday was the shit. For 9 days I drooled through reading and math lectures and it was worth it. I’ll tell you this. If you’re a fully-grown adult who has never played dodgeball against pre-teens, you are missing out. For that one sweet hour, I was the greatest athlete alive. With the flick of a wrist I could put a little kid on their ass. I was a lion on the savannah. A silverback. People say it feels great to make a difference in the community, but I wouldn’t know. I do know that it feels great to unleash a zinger that whips the glasses off a fifth grader while your eliminated opponents gasp in awe from the sidelines. I’m not telling you this to relive my glory days. I’m telling you this because investing in a tax-deferred account, where your money will compound over decades and decades, is like playing dodgeball against little kids. There’s a lot of room for error. You don’t have to be anything near perfect. You just have to be in the game. Could I have spent every spare hour at the gym and reached a point where my lock-and-loaded shot could have decapitated a child? And could you spend 10,000 mastering the art of investing so that you could be 100% you are doing the best possible things with your money? The answer to both of those questions is: yes, but not necessary. Just keep it simple - save as much as you comfortably can. Remember the chart above - as long as you get your money invested it’s going to multiply many times over.

The legal contribution limit to a 401k is $19,500 per year (employer contributions don’t count toward your limit). If you can afford to do that, then do it. You won’t regret having more money later in life. However, 401k accounts are special, regulated accounts. If you withdraw any money from them before age 60, you have to pay back any taxes and pay a 10% penalty fee. There are certain exceptions here, but you should plan as though any money you put into your 401k is untouchable until age 60. Remember, your 401k is yours for life so you keep the account even if you change jobs - you won’t be forced to empty the account until age 72 (when there are no penalties). Therefore, if you think you need your money before age 60 then keep that money in a regular investment account. There’s no right answer as to how much money belongs in your 401k vs. your rainy day fund vs. your regular investment account vs. rare pokemon cards. You’re not going to improve your life by agonizing over it. Remember, you’ve got a natural advantage here. Just get in the game.

Where to invest the money?

Every 401k will have its own set of investment options. You have the freedom of choosing, within that set of options, where your money is invested. Eh, “freedom” is a stretch. It’s a burden. Give me a pension, damnit! Here’s a quick set of 401k rules (keep in mind every 401k is different). My philosophy, as always, is to keep it simple and let long-term compounding do the work.

The first thing to look for is low-fee options. Most funds charge a fixed percentage of what you invest as a fee each year. Usually there is something called an “expense ratio” that tells you the annual amount. You definitely don’t want to go above 1%, (0.2% is the rate on the fund I chose).

There will always be options that look exotic and charge high-fees. You may have easily excited friends and coworkers that eagerly recommend them. Creators of these funds want suckers to see a fancy description and think “Oh, I simply MUST have this fund that invests exclusively in Parisian dog spas, I can’t miss out on that!” You can miss out. Let other people be suckers. Keep it simple and low-cost.

There are actively-managed and passively-managed funds. Unless you really know what you are doing, stick with passively-managed. Actively-managed means higher fees and higher risk. The fund description will make it clear whether a fund is active or passive.

The number one concern for any investor is losing your money. When you invest in anything besides cash, there is always risk involved. With a 401k, that risk is mitigated because you are investing over a long time period. This chart from Forbes illustrates how much risk is reduced when investing in the stock market over longer time periods, and this doesn’t even account for the tax benefits of the 401k:

For those of you who want more specific advice on which accounts to invest in. There’s usually “target retirement” funds that do a simple mix of stocks, cash, and bonds based on your expected retirement date. Those funds are usually totally fine.

If you don’t like your target retirement fund, a basic rule of thumb is to subtract your age from 100, and put that percentage of your 401k into stocks (remember low-cost passive index funds). The rest would go into cash or bonds (or anything that is low-risk/low-return).

There is no “right” answer as to what to invest in because it depends on your uniquely personal situation and risk appetite. Personally, I’m 31 and put 90% of my 401k in stocks, but I have financial professional friends who are closer to 30% or 40%. This is psychological, not logical. You need to be able to live comfortably with these decisions. You do yourself no good if you wake up every morning worrying about your 401k. If you are doing that, then you are taking too much risk. Do whatever feels comfortable and keep it simple. The magic of compound investing will take care of the rest.

What else do I need to do to avoid being murdered by my tontine cohort?

First of all you can't be murdered by a tontine if you kill everyone else off first. Having said that, if you have access to one, a 401k is the first line of defense against being forced to join a tontine. There are other options. IRAs offer the same benefits as 401ks (usually they don't have employer matching and the maximum contribution amounts are lower). Beyond that, there are some other sophisticated options that you can explore, but if you are maxing out your 401k and IRAs then you are already in really good shape.

I don’t think there’s any value in overdoing your 401k research. The way I think about it is that to get another 1% of performance beyond what I’ve outlined here takes 100s of hours. You’re better off investing that time developing a skill that can raise your income permanently. Or just doing something that is actually fun. That will pay off much better than 401k expertise.

401k should be your first tax-advantaged savings option, but if that’s not available (or if you max it out) here some links to other options