Why are there suddenly so many ads for budgeting apps?

annoying ads: an investigation

The internet (or at least my internet) is inundated with ads for budgeting apps. Apparently there’s a lot of people who subscribe to stuff and then forget they subscribed.

These apps log into financial accounts and flag subscription charges so that the user can tighten their spending. The catch, of course, is that the apps get user data which they can use to sell you toasters or infiltrate your subconscious and manipulate you into a marital relationship with a Waifu pillow. Remember if the meatball is free then you are the meatball.

Free apps that collect data are nothing new, and budgeting apps are nothing new, but advertising for this specific value proposition - identifying subscriptions across all a user’s accounts - is new. Or at least, it’s being promoted heavier than ever. Rocket Money paid ~$8 million for a Superbowl ad. What’s changed?

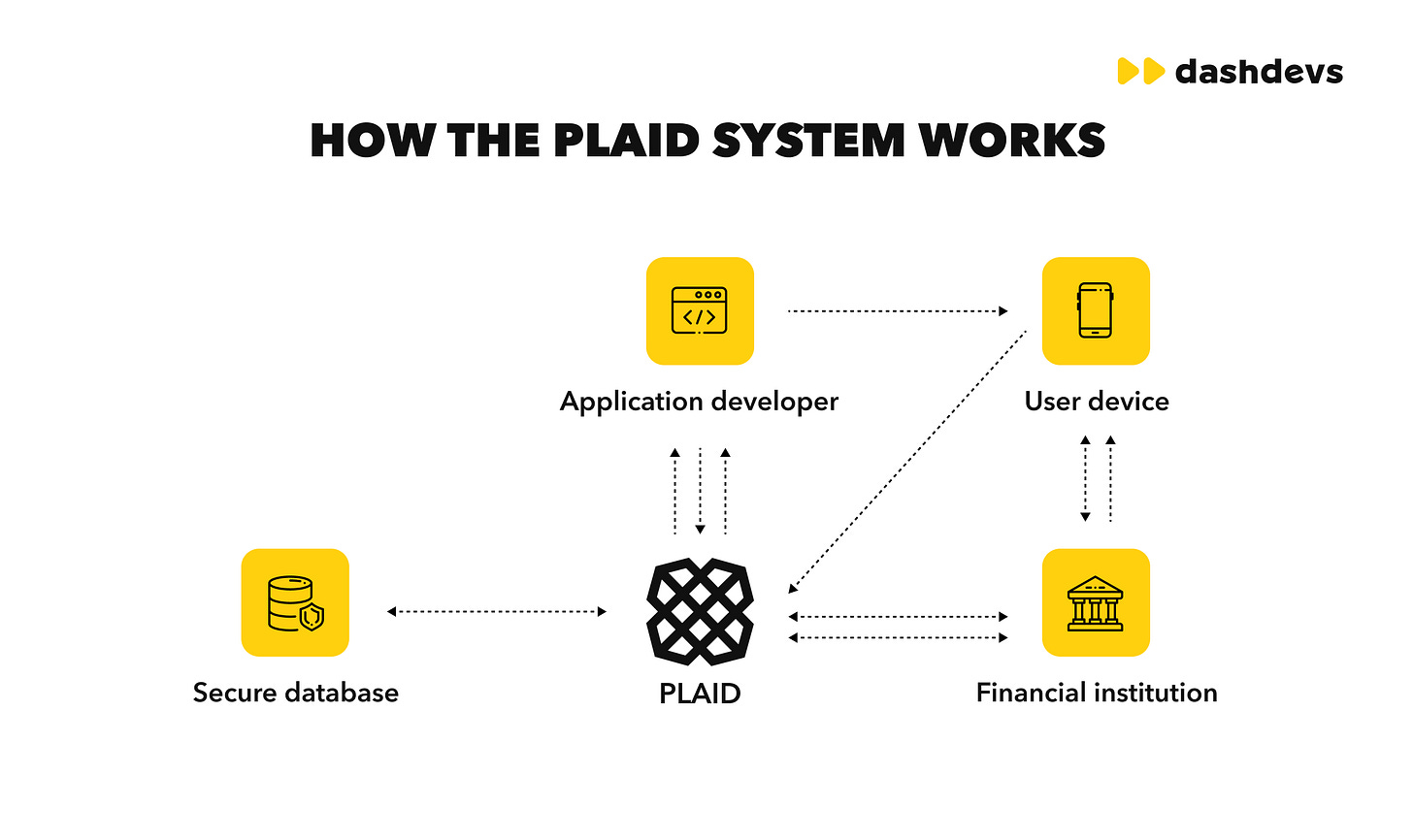

The answer is open banking. Open banking is a concept where financial institutions can securely and effectively share data. In a utopian open banking future all financial transactions are instant and seamless. No waiting three days for Venmo to move money to your checking account, no having to retype your credit card information on a thousand sites, no more having your card declined for suspicious activity when you try to buy a bottle of wine that costs more than $8.

It’s a beautiful future, but getting there has been a slow and arduous journey. The main challenge has been technological. Banks and Fintech companies (like Plaid, founded in 2013 and recently valued at $13 billion) have spent billions of dollars building up the IT infrastructure to support an integrated ecosystem. The second challenge has been resistance from incumbent financial institutions who make a lot of money in a closed banking system. Big banks in the US dragged their feet on integrating with open banking partners and in some cases actively tried to suffocate them by cutting off access.

Around 2021 open banking adoption accelerated for two reasons.

First, policy changes. Europe passed a regulation called ASD2 in 2015 which effectively forced large financial institutions to adopt open banking. The Consumer Financial Protection Bureau announced a similar rule coming into effect in 2026. However, it was clear much earlier that such a rule was coming. In 2020 the Justice Department blocked Visa from acquiring Plaid and industry executives saw the writing on the wall: open banking was inevitable. The big banks accelerated their open banking investments and the ecosystem started rapidly improving.

Second, and somewhat related, were that technology improvements dramatically improved reliability, security, and performance of features like APIs. I think the improvements were mainly a function of investment. Once big banks realized open banking was inevitable, they increased their spending. More coders, better computing resources, more senior executives coordinating between banks and boom: acceleration in open banking features & performance. Of course Substack writers are contractually obligated to attribute any technology advance this decade to AI. So, open banking has seen a massive productivity explosion attributable to AI.

One consequence of an improving ecosystem was that by the early 2020s budgeting apps got way better. Ten years ago budgeting apps were clunky and glitchy. If an app like Mint Mobile wanted to amalgamate the financial activities of an individual into one app, it had to rely on screen scraping and manual work by the user. A lot of data in the app was stale or required the user to spend a lot of time cleaning up. However by 2022 the apps could rely on APIs which seamlessly pull data real-time from banks and credit card companies.

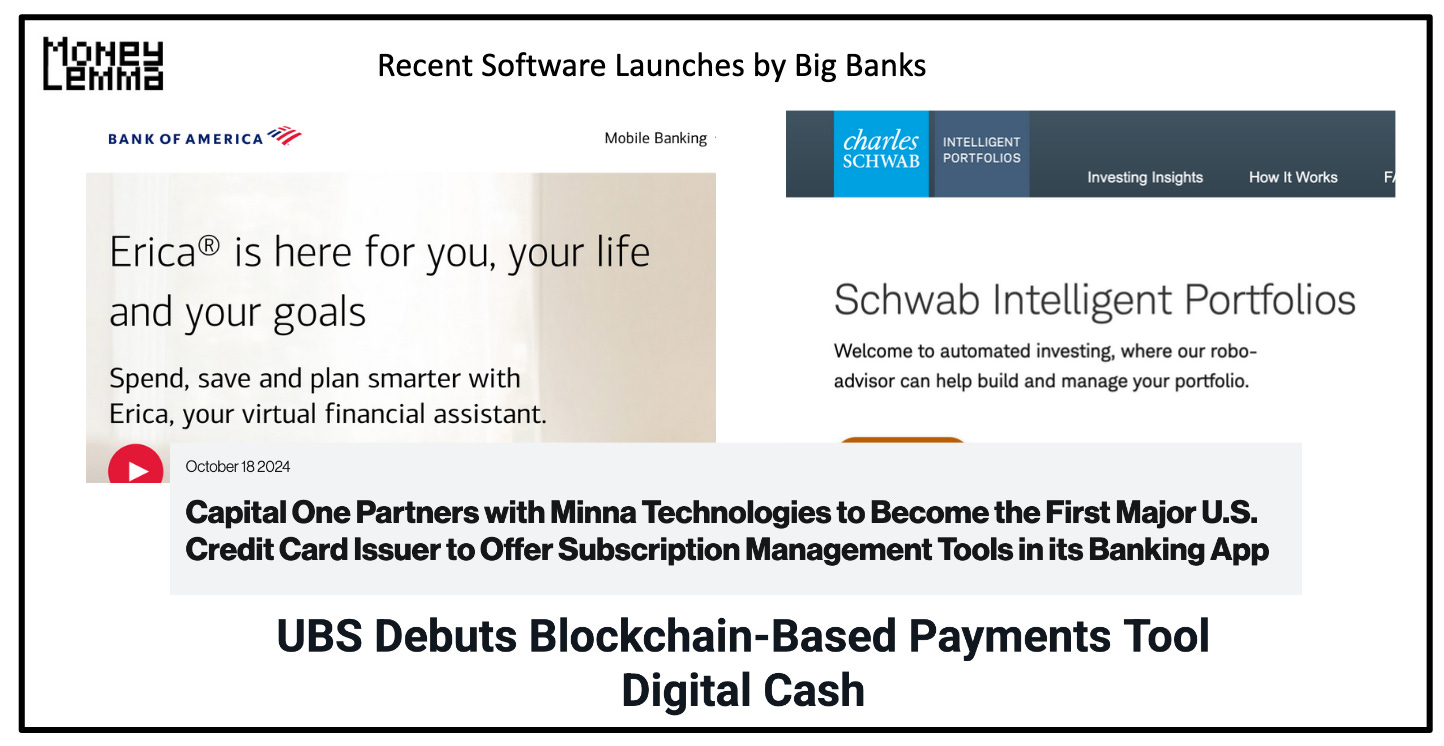

Large financial service companies like Rocket Mortgage, Quicken Loans, and Credit Karma have always had budgeting apps but thanks to open banking they have much better budgeting apps than ever before. My guess is that these apps are demonstrating high loyalty, strong retention, and are generating treasure troves of data. That’s created a gold rush scenario where companies are racing to vacuum up as many users as possible before those users end up on a competitors platform. And that is why these budgeting ads have become ubiquitous.

What exactly is all this data good for? Here’s Rocket Money’s CEO explaining the company’s vision:

“You leverage AI capabilities to understand what mindset the client is in. When they are ready to engage in another transaction. AI equips us with the ability to have a specific and quantifiable understanding of the intent of the consumer. We leverage that for better targeting and personalization.”

In other words, these companies are happy to give you a free budgeting because they believe the data will help build mortgage products, better 401ks funds, better financial advice, and all around better products. Those are all things they can charge you for. And that is why there are so many ads for budgeting apps right now.

There’s also a longer game being played around the open banking disruption. Look at the path of mobile phones. Early phones differentiated on hardware: battery life, cell service, portability, etc. Today, that technology is mostly commoditized, at least as far as the average user is concerned. Modern phones are mostly differentiated on software. People choose their phones based on the operating system. Apple’s biggest selling point for the latest iPhones is its AI features. Banking could go a similar route. Before open banking the most important financial institutions were the ones doing the plumbing: storing, lending, borrowing and otherwise moving money. Rocket Mortgage, for example, became a $30bil company by offering fast approval on loans at competitive interest rates.

In an open banking world it will be harder to differentiate on the plumbing because the whole point of open banking is the plumbing is easily accessible. If anyone can offer instant loan approval at similar rates, Rocket Mortgage isn’t differentiated at all. That’s why Rocket Mortgage’s CEO talks about Rocket becoming the “Apple of Home Ownership.” Similar to how Apple built an integrated software ecosystem that creates a great experience for the user, Rocket wants to create an integrated financial experience. Rocket Mortgage is not alone. Financial institutions are increasingly looking to make user experience and software the cornerstone of the business rather than plumbing (prices, rates, fees, basic features, etc).