Is Aldi cheaper than Walmart?

the anticipation must be splintering you apart from the inside out. Hurry, read on!

I wrote this post after chatting with Andrew Watson who writes an interesting e-commerce blog you should check out!

For a long time stuff has been getting cheaper here in America (cheaper = more affordable, not deflationary). I’m not talking about healthcare, college tuition, haircuts, dog walkers, or car insurance. Those are services. If the American household balance sheet is a stomach then services are an infectious tapeworm sucking up all nutrients and leaving their hosts emaciated. Stuff, consumer goods, has truly gotten cheaper:

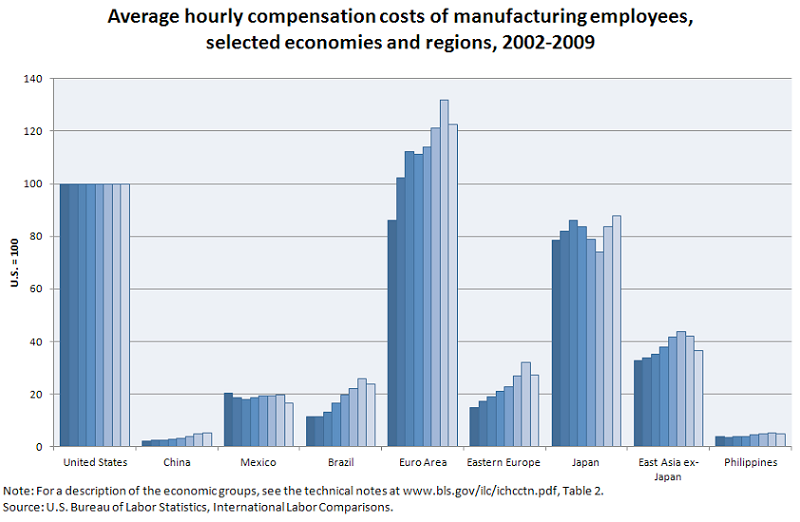

The general explanation for why consumer goods have gotten cheaper (and why consumer services have not) is globalization. Over the past 50 years richer countries outsourced manufacturing to countries where labor, land, and other factors of production are cheaper. Improving technology (LEDs for TVs) and economies of scale (cheaper microchips that go in the TV) further pushed down costs.

I think there’s another factor which is less appreciated: retail innovation.

Retail is the art of getting stuff to the customer. Take a banana. The cost of producing bananas has come down 20x over the past 200 years. However, if a crate of ten cent bananas just gets dumped at a New York harbor then that’s not going to do much for most people. Unless swinging by the banana docks is part of your regular schedule (note to self, swinging by the banana docks is a great euphemism for sex).

The job of the retailer is to get the bananas from the docks to the folks. Retailing will always require another layer of extra cost beyond manufacturing. Whether it’s a storefront with cashiers or a fulfillment center where online orders are packaged and shipped, retailing has to cost something. Retail innovation describes the efforts businesses have made to reduce that cost to a minimum. Two of the greatest retail innovators, Walmart & Aldi, started in the post-war era. Both have led prices on their downtrade trend for decades, but each in their own way.

Walmart: high volumes, low price

Walmart is the world’s largest retailer. But just as the Wicked Witch of the West was once an earnest schoolgirl, Walmart was once a scrappy upstart. Sam Walton founded Walmart in 1962 with one goal in mind: make the shopping experience as soul-sucking as possible. And boy did he succeed. Alright, fine, the goal was to sell things as cheap as possible.

Mid-century retailers typically tried to maximize gross profit per item. The gross profit of an item is the sale price minus the cost of that item. Sell a banana that cost you a dollar for $1.10, and you’ve made ten cents in gross profit. Walton realized that if he made his goal minimizing gross profit per item, he would attract more customers with low prices. He would sell his banana for $1.05 and make a nickel per banana, but he would sell 3x as many bananas as a normal retailer. His margins might be lower but his total profit would be higher. In modern retail economics parlance, Walton emphasized volume over price (where volume x price = revenue). Walton built his empire around this golden principle of gross profit minimization. You can go back to his earliest annual reports and read it in his own words:

Aldi: low costs, low price

Around the time the first Walmart opened, two German brothers took over their family grocery store. They too were obsessed with price minimization but took a different angle. Whereas Walmart’s insight was on gross profit, Aldi’s focus was on SG&A. The economics of retail profit can be broken down into Gross Profit and SG&A. SG&A (selling, general and administrative) is all the costs a store has that are not specific to any item. Cashier wages, shelving, electricity, rent, mopping up puke, monkeys living in the vents shoplifting your bananas.

The Albrecht brothers realized that a retailer’s ability to minimize price is constrained by SG&A. If a store buys a banana for $1.00 and sells it for $1.01 they make a gross profit of a penny. But they’ll never sell enough bananas to cover SG&A costs. A retailer’s ability to reduce prices is therefore constrained by its SG&A. Minimizing price was about minimizing SG&A. The less overhead a store has, the cheaper it can sell products. Whereas Walmart made volume maximization its religion (high volumes, low price), the Albrecht brothers worshipped cost minimization (low cost, low price). And if frugality was their god, they’re piety was unmatched. Once Theo Albrecht (one of the brothers) got kidnapped, paid his ransom, then negotiated a ransom tax deduction with the German government.

Aldi’s stores are indecorous warehouses in offbeat locations. Checkout lines are long and employee help is nonexistent. The merchandise is displayed like a shipwreck, as if a pallet of oranges had washed ashore and spilled into an aisle. But man is it cheap. No-frills means cutthroat SG&A which means Aldi can sell stuff for less than anyone.

Walmart vs. Aldi, which can sell cheaper?

Both Walmart and Aldi were true retail innovators. Both reinvented how to run a retail store and in doing so brought down prices for consumers. Which one did it better?

Walmart’s gross profit margin is 25%, and Aldi’s is around 20% (they aren’t public so they don’t share that, but an industry insider once told me it was around that range). That means that, if Walmart buys a banana for $1.00 they will sell it for $1.25. Aldi will sell that same banana for $1.20, or 4% cheaper. Ok, so Aldi is cheaper.

The catch is that the typical Aldi store has about 1,500 SKUs (stock-keeping units, meaning unique items on the shelf). This goes back to Albrecht's goal of minimizing SG&A. The brothers wanted small stores to keep costs down. A typical Walmart store, meanwhile, has 150,000 SKUs. Walmart sells everything from dog food to motor oil because they’re goal is to maximize volumes (sell more stuff at lower prices, make more absolute money). Therefore if both Walmart and Aldi sell a product, Aldi can sell it cheaper because they have so little overhead. But, because they have so little overhead, they don’t offer much breadth. 95% of what Walmart sells isn’t available at Aldi. That means it’s a tie! Both are winners!

What’s interesting is that Walmart’s fixation on volume maximization led to lower SG&A, and Aldi’s fixation on SG&A led to higher volumes. For example, Walmart’s strategy to become a superstore (sell everything to everyone) led to them to have lower SG&A. SG&A, as explained earlier, is largely a fixed cost, meaning it doesn’t increase when the units sold increase. Bananas, by contrast, are a variable cost for a retailer. Each additional banana you sell requires you to go out and buy a banana. Walmart maximized the volumes it sold. In doing so, it increased its revenue but SG&A was constant. In other words, Walmart’s SG&A as a percentage of sales became low, nearly as low as Aldi’s. Walmart also chose to open its megastores in remote areas (that’s why it’s headquartered in Bentonville, AK). The idea was there was less competition which meant more volumes for Walmart (less places to shop = more market share for Walmart). But it also meant cheaper rent (lower SG&A, probably even lower than most Aldi’s on a square foot basis).

Aldi, meanwhile, kept its stores small to keep costs down. That also forced them to choose only the best-selling 1,500 items to stock in their store. Naturally they choose the best-selling items. As a result Aldi has probably the highest inventory turnover (an industry metric for volumes sold per product) out of all retailers, even higher than Walmart (the original volume maximizers).

Retail innovation never ends!

Aldi & Walmart were founded in the post-war world, but retail innovation didn’t end with them. Costco pioneered the warehouse membership model. Costco’s strategy is to sell everything at cost and make all their profit off their customer’s annual membership fee. Costco’s 13% GPM is lower even than Aldi’s!

Amazon’s e-commerce marketplace was premised on the idea that a website can strip out most of the SG&A of a regular store (aisles, checkouts, lights, automatic doors, high-rent areas, cashiers) and allow them to sell products cheaper than any store. Now Temu is going one step further and trying to let factories in China sell directly to US consumers (cut out the Amazon fees).

Different low-cost retail strategies work well for different products. Amazon or Temu is probably the cheapest place to find a simple electronic product like a charger. But a jug of olive oil, which is more expensive to ship, might be cheaper at Costco which specializes in bulk products. Meanwhile, Walmart can probably sell a branded food product (like a can of tomato sauce) cheaper than anyone else because they get massive volume discounts (Walmart has 25% market share of US grocery). If you don’t mind buying unbranded, then Aldi can probably undercut Walmart with a generic brand of sauce.

The beauty of retail innovation is people are always finding ways to sell things cheaper. Right now there is a fast-growing discount retailer (sort of like a dollar store) in Europe. They’ve found a way to sell basic toiletries, household items, toys, and all sorts of other stuff cheaper than anyone, even Walmart. You can check out this post by Dollar Commerce (who I shouted on in the intro) to learn more about them: