Why did Venture Capitalists give to $5 billion q-commerce companies in 2021?

pay attention potheads, this one is for you

Welcome all new MoneyLemma subscribers! Last year MoneyLemma covered the Venture Capitalist art of building a unicorn. We looked back on scooter-sharing apps, Cirque du Soleil, and other companies to reach a billion-dollar valuation. This week we are looking forward. Q-commerce is a big bet Venture Capitalists are making right now. Read on to find out what that means!

But first, I’d like to share some bullshit with you

This is bullshit and so can you is one of my favorite newsletters. It’s chock full of dumb jokes, rants, explainers, and, well, nonsense. You thought I was going to say bullshit, didn't you? This is bullshit and so can you has a mixture of absurd content like: how inflation is actually calculated, why cannibalism gets a bad rap, and the realities of #VanLife. Lebron James even reads it. No, not that Lebron James. A different one. Does all this sound kind of like MoneyLemma? Yes, but the topics cover a much broader range of topics and, to be honest, it’s funnier.

Why did Venture Capitalists give to $5 billion q-commerce companies in 2021?

Dora the Explorer always catches Swiper the Fox just an instant too late:

Investors and consumers have this in common with Dora: they’re always too late. Found a great stock? Too late, it's already so overpriced it makes Dogecoin look like a Kohl’s clearance rack. Realized that Purdue Pharma, makers of Oxycontin, were less a legitimate drugmaker and more a state-sponsored cartel? Too late, the US already has 150 million opioid prescriptions. Discovered McDonald’s uses tire rubber instead of patty meat? Too bad, over 100 billion served.

The best time to invest in a business is early, as in, before the crowd, but also as in when things are still uncertain. Once uncertainty is gone, so is the opportunity for excess rewards (MoneyLemma on the inextricable relationship between risk and return). Likewise, the best time to regulate or in any way change a business or industry is early. Early because consumer behavior can be intractable once set. Early because as more money is sunk into a project, whether its an oil pipeline or Disney’s Frozen On Ice, livelihoods become dependent on that project, and dependence breeds resistance to change. Early because once an industry matures there’s plenty of money for publicity campaigns, lobbyists, or anything else to suppress opposition:

If we were Dora, the solution would be to hide in a tree, wait, then drop a brick-filled Backpack on Swiper’s head. Get there early and turn that degenerate into a fuzzy floor mat. But we aren’t Dora. For us, the strategy is Venture Capital fund flows.

Why Venture Capital is a glimpse into the future

New businesses or industries don’t just appear overnight. They take enormous amounts of time and money, testing and repeating, tinkering and logo-designing, and many, many colorful slide decks filled with Gandhi quotes. Take electricity. The Electricity Supply Act of 1926 established the national grid - almost fifty years after Thomas Edison’s lightbulb epiphany. For decades industrialists, politicians, academics, and engineers worked on building the infrastructure, agreeing on the rules, educating the public, and pushing for consumer adoption. Eventually electricity as an industry matured into the basic utility it is today (at least in the US). This innovation cycle repeats, with remarkable consistency, across different modes of the economy.

While making specific predictions is difficult, the innovation cycle makes the big-picture outlook visible: in the late 1990s nobody knew Google would become a trillion-dollar company one day, but it was apparent to anyone who understood the internet that search was going to be a big opportunity:

The problem, of course, is that early is hard. Sure, if you had a computer science degree or lived next door to Ask Jeeves (AJ to his friends) you might have concluded internet search was the next big thing. Really, being early means being informed. Informed people have some sort of sustained information edge. They can be nerds worth cheating off of, gossipy drama queens, braggadocious power brokers, even unctuous little Smeagle-types who cozy up to bigwigs and siphon off information by way of flattery. Most of us aren’t those people. Luckily, we don’t need to be. A class of investors called Venture Capitalists have emerged as early-stage specialists (MoneyLemma on how Venture Capital works). Venture Capital has become big enough that it can be used as a proxy for understanding what types of big ideas are attracting money, labor, and attention. When a big idea is getting all three of these things, that means informed investors (Venture Capitalists) see a transformation on the horizon, the next big thing. Q-commerce, an emerging class of companies getting billions of Venture Capital dollars, is a great example of a coming transformation. Let’s see if we can get there early.

What is q-commerce?

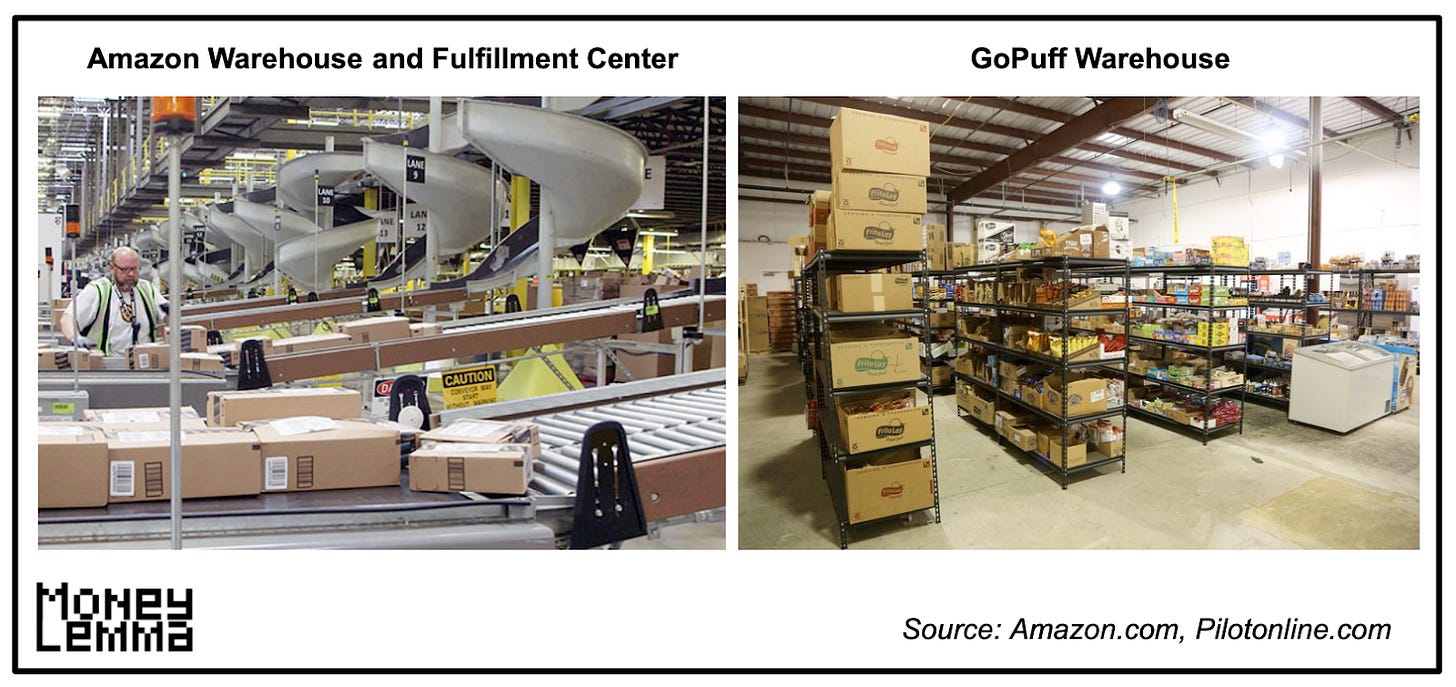

Q-commerce, or quick commerce, is a term for mini e-commerce warehouses dedicated to hyperfast delivery. Think of them as convenience stores without customers. Instead they are staffed with logistics teams that pack and deliver online orders in 30 minutes or less. Rapid delivery requires three things: a clean front-facing interface (aka a really good app), militant backend efficiency (every step must be optimized), and warehouses located in densely populated areas. This last point is important: the best way to deliver fast is to be close to customers. Unlike traditional warehouses, q-commerce locations occupy expensive real estate, which is why they are small and carry a narrow range of products. Think of q-commerce as Domino’s for essentials.

Q-commerce is is perfect for anyone in a stoned stupor craving a Hot Pocket, anyone too high to navigate their pantry, or anyone who urgently needs rolling papers to get high. Actually, although many of these companies did originally cater to pothead demographics, the use-case has expanded considerably, and the demand for rapid delivery is growing exponentially (more on that later). That’s why these companies raised upwards of $5 billion in 2021:

How does Q-commerce fit into the broader logistics picture?

MoneyLemma’s piece on e-commerce covered how online shopping is a function of price and convenience: each time a new product or service makes an e-commerce cheaper or more convenient, a new segment of customers is unlocked. Eventually, the majority of commerce will go digital.

In the late 1990s Amazon and others began to identify a major reason people weren’t shopping online was delivery time. The math became pretty simple: people will wait two weeks for a microwave, two days for a porcelain bowl, one day for a case of ramen, and thirty minutes for a hot bowl of noodles. Any company that could deliver products quicker would gain access to more customers. More customers means more sales, which means larger order volumes, which means lower costs, thereby solving both the price and convenience problems in one swoop.

Different companies have taken different approaches to cutting down delivery times. The major e-commerce players have built or rented large, automated warehouses connected to delivery fleets. Traditional retailers like Best Buy, Home Depot, and Target have leveraged their store footprint as mini-warehouses: oftentimes e-commerce orders are fulfilled by store employees who just pick the items off a shelf (a big part of why Amazon bought Whole Foods). This approach has been coined “omni-channel.” For digitally focused companies

that don’t have stores, “micro-distribution centers” are an option - these are something in between mega warehouses and Q-commerce. Then there’s a slew of other companies who have come up with solutions: DoorDash pays drivers to pick up their orders then deliver it to customers. One of Amazon’s big breakthroughs was using Prime memberships to effectively bundle purchases and lower costs. Wayfair created augmented reality apps and customized their shipping solution for bulky furniture. Chewy specialized their customer service for pet owners. The list of tried (and failed) convenience innovations is nearly endless, and the logistics infrastructure built out today is amazing:

However, these solutions are yet to be proven effective for widespread hyperfast (<30 minute) delivery, which is the slippery little eel of e-commerce. Hyperfast delivery is hyperhard. In the food industry there’s a concept called the “iron triangle” - food can be fast, cheap, or good but it can’t be all three. Lucky for restaurateurs, customers will settle for mediocre food if it’s cheap and fast. When it comes to delivery, companies have no such luxury. Q-Commerce companies have to rapidly pack and hand-deliver small orders, and since online customers are price sensitive they can’t charge more than a few dollars for delivery. If they mess up the service they’ll have to refund all the money. It’s got to be cheap, fast, and good. At face value it seems like the economics will never work. How can such a job be done profitably? As of yet, no e-commerce company can sustainably offer hyperfast delivery on a large-scale. Even Amazon, Zeus of e-commerce, has struggled to crack this code.

That’s what’s unique about q-commerce companies - they seem to be following a new playbook for hyperfast delivery. First of all, nothing should be delivered instantly unless it needs to be. Meaning that if a customer will wait more than 30 minutes, they should wait. Fast delivery is expensive and should be reserved only for customers who would otherwise stubbornly leave items in their basket. The industry has, at least for now, determined a 7-Eleven like inventory is suitable: basic staples like Tylenol or caffeinated Tic-Tacs are what makes sense for hyperfast delivery. Next, cluster mini-warehouses in populated areas. While real estate is more expensive, the delivery time will come down (deliverers are paid per hour) and higher density means more efficient routes. A big differentiator for these companies is that they don’t allow customers inside. No customers means the store layout can be completely optimized for e-commerce. Put all that together, and that is the beauty of q-commerce. Of course, q-commerce startups aren’t the only ones who can use this model. More traditional e-commerce companies are already experimenting with smaller warehouses located in urban areas. If there’s one thing Amazon and Walmart are good at, it’s crushing upstart competition.

Could Q-Commerce crack open two-hour delivery on a large scale?

Maybe. Any company that cracks hyperfast delivery will make investors and potheads happy. Q-Commerce could be the answer, or the answer could be delivery drones or autonomous cars or some kind of elaborate underground tube system as of yet unannounced. Clearly Q-Commerce is in the running because informed investors are betting on it. The bigger picture is that demand for hyperfast delivery exists. There’s probably demand for whatever is faster than hyperfast. As investors that is a fact worth evaluating now: how will different companies be impacted by hyperfast delivery? The consequence for consumers is more important. The conclusion of MoneyLemma’s e-commerce post was that 15% e-commerce penetration has fundamentally changed the physical world we live in, the way we interact with each other, and our culture. Hyperfast delivery is trying to bring the next 5% of retail sales online. That means less physical retail: fewer stores to go into and more vacant real estate, which will eventually be turned into condos or taken over by a Sweetgreen (apparently the only physical business in a digital world).

But it’s still early. It’s still early! Hyperfast hasn’t happened yet. That means that now is the time to thoughtfully position ourselves as consumers. At this early stage consumer technology has a way of hoodwinking the world by launching in niche markets with highly discounted offerings. People are so blown away by an amazing value proposition they sign up without thinking twice. While we’re all busy taking discounted Ubers or uploading our personalities to Tik-Tok, these companies are becoming more powerful. That’s why now is the time to consider the longer-term consequences of hyperfast delivery. Certainly it’s convenient to get a Slim-Jim on short notice, can’t argue with that. But what about after that? Environmentally, politically, economically, culturally, there are major consequences to think through. And if the conclusion is that hyperfast delivery is great, that’s totally fine. But if the conclusion is the opposite, then now is the time to act (or, not act). As consumers we get to vote with our wallets on what we want the future to look like. If we wait to vote, the value of those votes decays because our habits ossify and the companies sphere of influence expands. Businesses are getting smarter and consumers need to get smarter too: we need to arrive at our conclusions earlier so that we can forcefully participate in the building of tomorrow’s world. The time to think about the future is now.